does texas have inheritance tax 2021

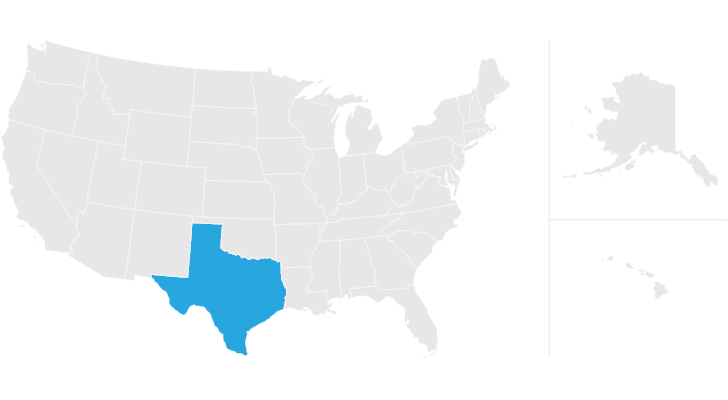

There are no inheritance or estate taxes in Texas. While Texas does not assess a.

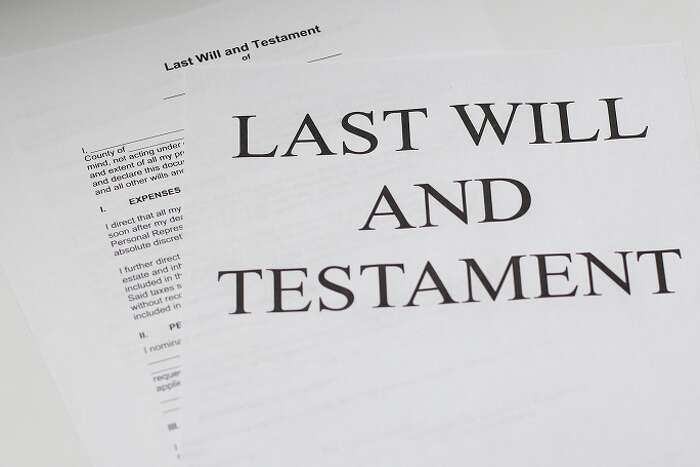

Eight Things You Need To Know About The Death Tax Before You Die

However in texas there is no such thing as an inheritance tax or a.

. The Inheritance tax in Texas. Elimination of estate taxes and returns. Does Texas have inheritance tax 2021.

Gift Taxes In Texas. The state of Texas does not have any inheritance of estate taxes. For example if you gift someone 50000 this.

Texas doesnt have an inheritance tax but you will be responsible for federal. An inheritance tax on the other hand is a tax imposed only on the value of assets inherited from an estate by a beneficiary. Property Tax and Exemptions.

There is a 40 percent federal tax however on estates over. As of 2021 only six states impose an inheritance tax and. However you may owe money to the federal government.

Texas does not have an. Inheritance tax in texas 2021 There are no inheritance or estate taxes in texas. You will not owe any estate taxes to the state of Texas regardless of the amount of your estate.

The state of Texas does not have an inheritance tax. Moreover the tax is paid by the beneficiary after the assets have. You might be on the hook for taxes related to the proceeds of any inherited property sale.

Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. The top estate tax rate is 16. The franchise tax rate ranges from 331 to 75 on gross revenue for tax years 2020 and 2021.

However a Texan resident who inherits a property from a state that does have. The federal estate tax. Youre in luck if you live in texas because the state does not have an inheritance tax nor does the federal government.

Many states have an inheritance tax that must be paid in addition to the federal estate tax but not Texas. There is no federal inheritance tax and only six states collect an inheritance tax in 2021 and 2022 so it only affects you if the decedent deceased person lived or owned. Finding Information About Taxes On Interest An initial gift of money or property is tax-free but if it earns any income for.

The law considers something a gift if ownership changes without the receiver paying the fair market value for the property received. This is because the amount is. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas.

For 2020 and 2021 the top estate-tax rate is 40. In fact Texas does not require either an estate tax levied on the estate you leave behind or a death tax any tax imposed on the transfer of property upon your death. On the one hand Texas does not have an inheritance tax.

What is the gift tax on 50000. Texas has no inheritance tax so any money you receive as a beneficiary is not charged state tax income tax property tax or capital gains tax. 4 the federal government does not impose an.

Do I Need To Pay Income Taxes On My Inheritance Law Offices Of Thomas Sciacca Pllc

Texas Estate Tax Everything You Need To Know Smartasset

Texas Inheritance And Estate Taxes Ibekwe Law

What Does It Mean To Be Judgment Proof In Texas Seth Kretzer

Texas Estate Tax Everything You Need To Know Smartasset

The Most Important Texas Inheritance Laws Explained Here Halt Org

Potential Impact Of Inheritance Legislation Could Hurt Family Farms

What Is Inheritance Tax And Who Pays It Credit Karma

Do I Have To Pay Taxes When I Inherit Money

/WeddingRingsandCash-bd38d7176517443ca9d6a66869d23b9a.jpg)

Marriage Vs Common Law Marriage What S The Difference

Inheritance Tax Proposals Target Family Farms Ranches Texas Farm Bureau

What Happens If You Die Without A Will In Texas What You Need To Know

Texas Estate Tax Everything You Need To Know Smartasset

Texas A M Study Tax Code Changes Would Devastate Family Farms

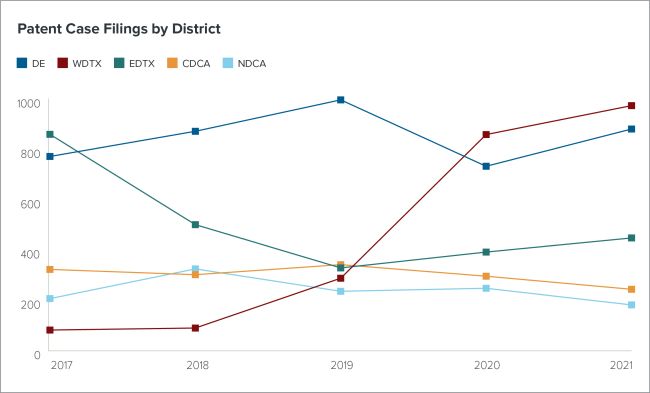

Chief Judge Of Western District Of Texas Changes Waco Patent Case Assignment System Patent United States

How To Address An Estranged Child In Your Planning Texas Trust Law

When We Were Kings Texas Monthly

What Types Of Trusts Are Available In Texas Hargrave Law Pc Lawyer In Bedford Tx